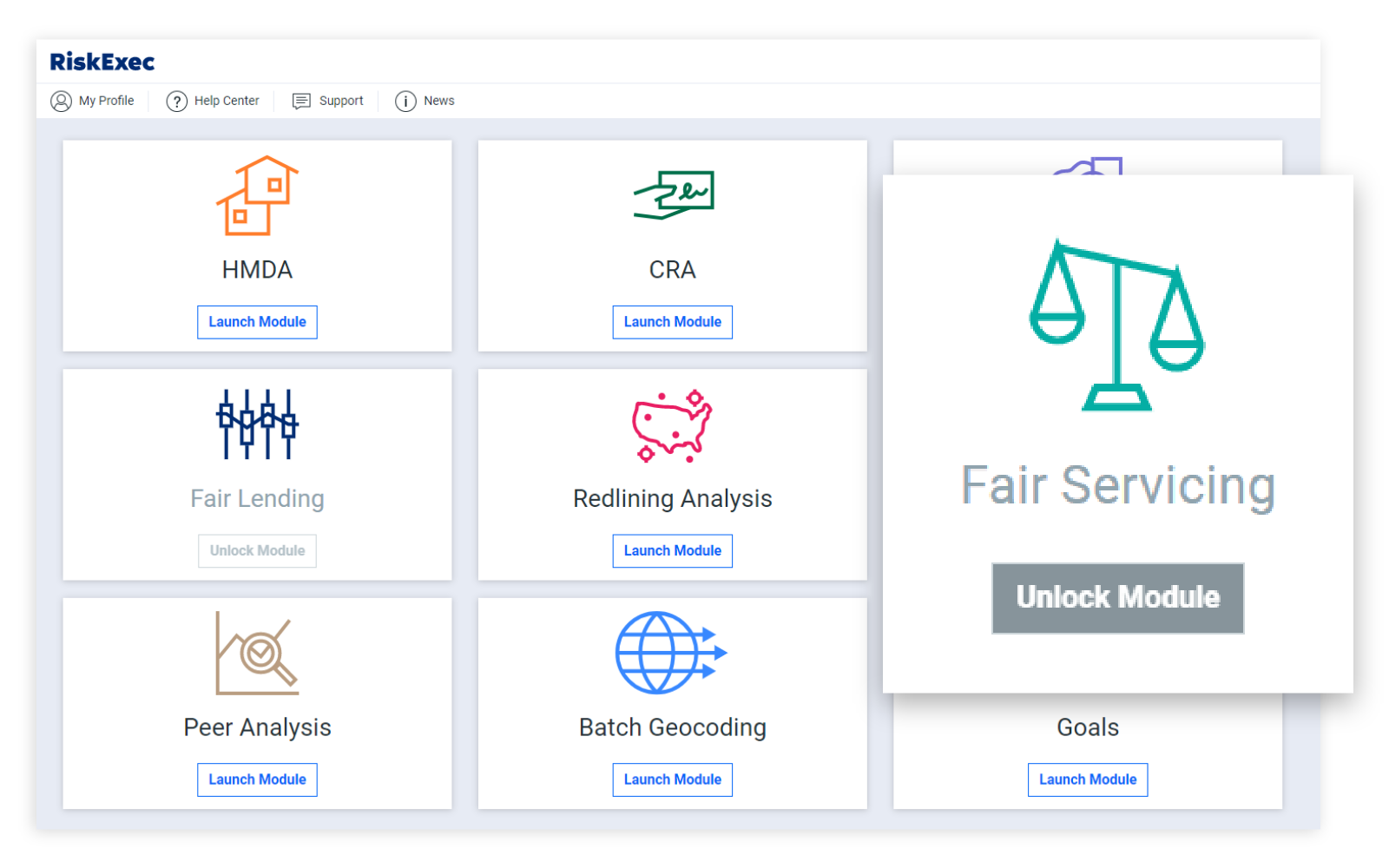

- Products

- Advisors

- CMS Reviews

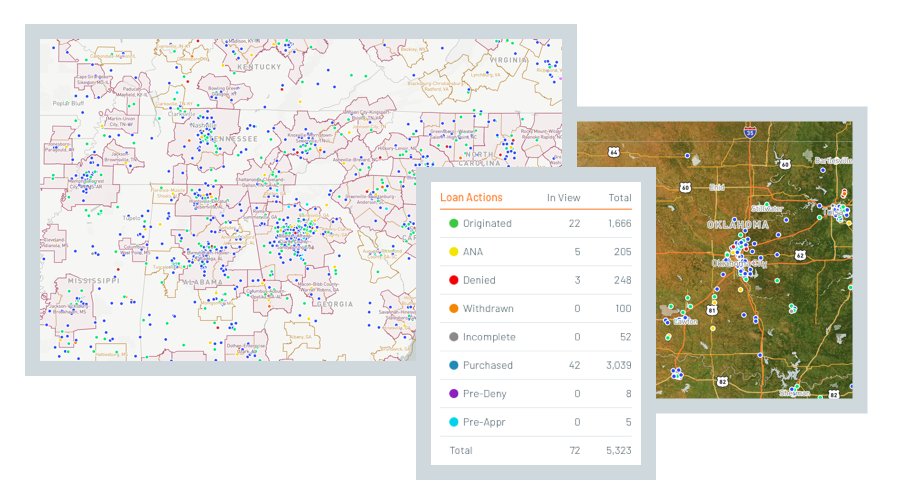

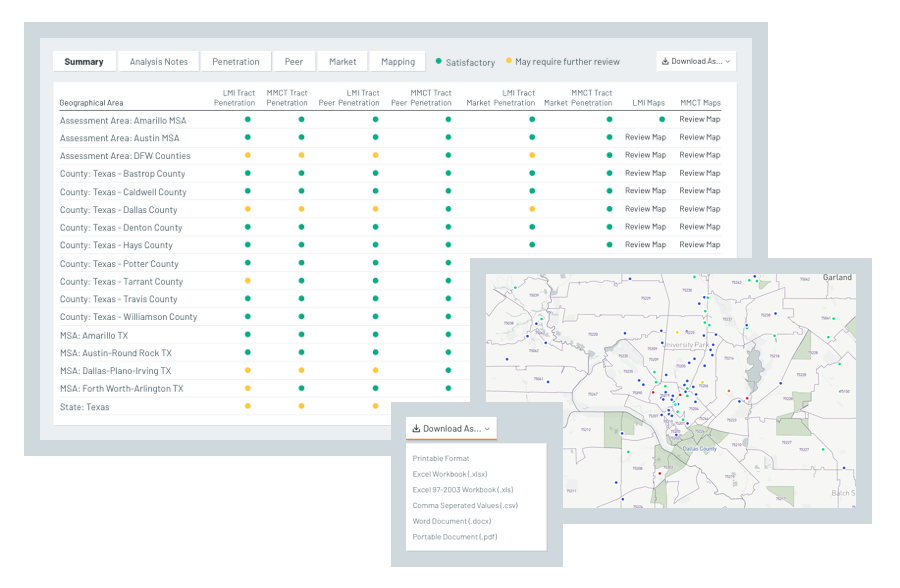

- Fair and Responsible Banking

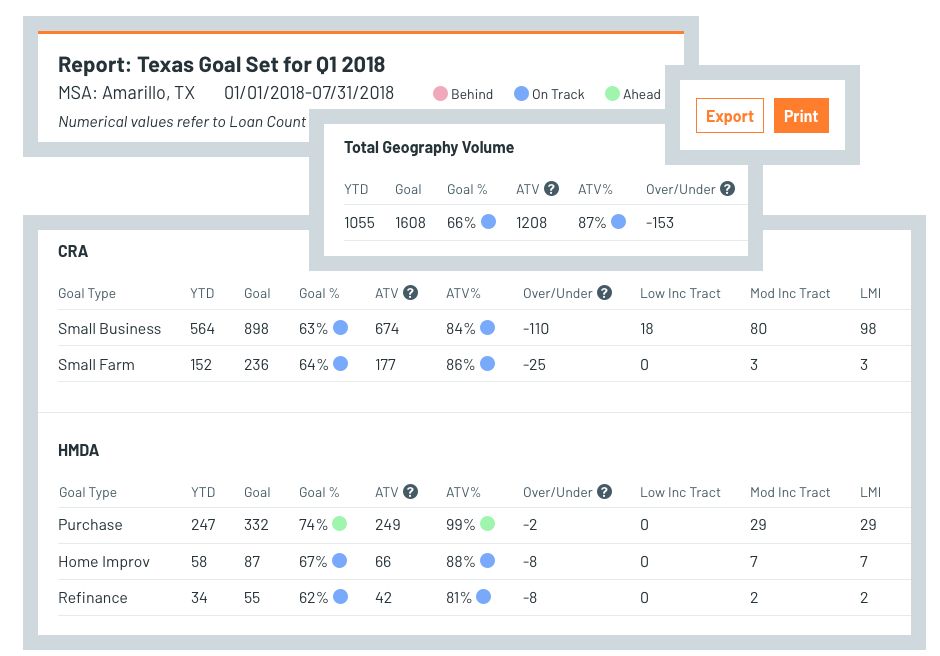

- Community Reinvestment Act (CRA)

- Small Business Lending /Section 1071

- Crossing the $10B Threshold

- Fintech Compliance / Banking-as-a-Service

- Mortgage Support and HMDA Services

- Staff Augmentation/Managed Services

- Enterprise Risk Management

- Operational Reviews and Process Improvement

- Mortage Services

- Insights

- About Us