Assessing or monitoring fair lending risk requires specialized expertise and tailored technology resources that most institutions lack. Engage our expert team to conduct a Fair Lending Risk Review and identify any areas of disparate treatment, disparate impact, redlining, and/or steering.

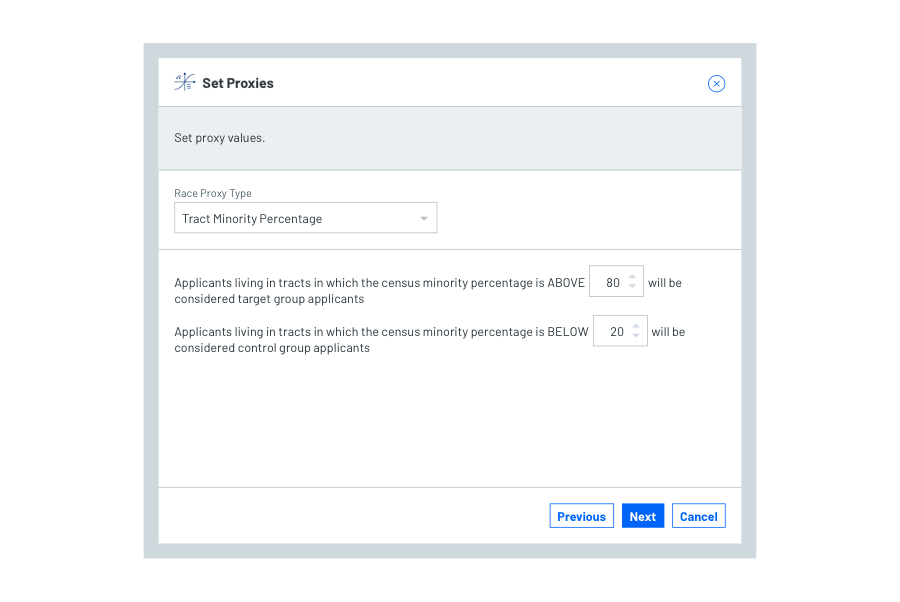

Assign race and ethnicity to non-mortgage products.

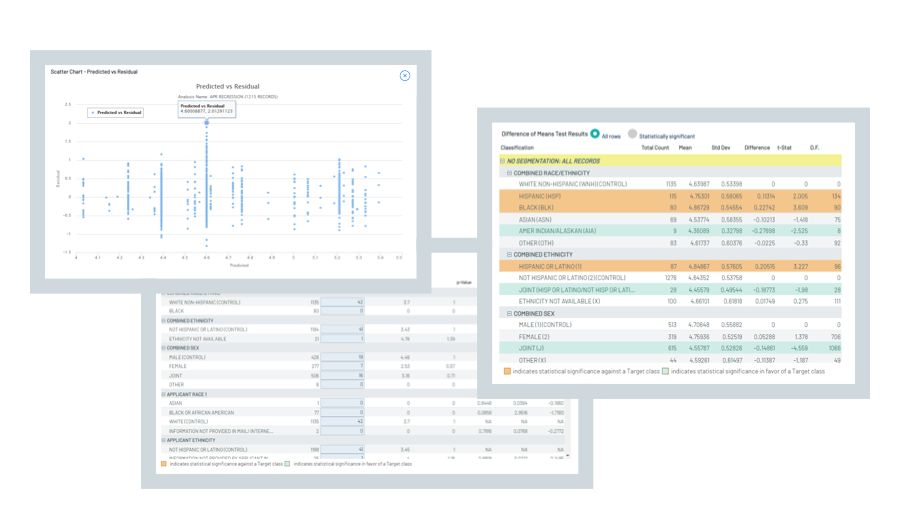

Uses statistical models to identify and to explain the root cause of any fair lending risk factors and assist you in accounting for any inconsistencies.

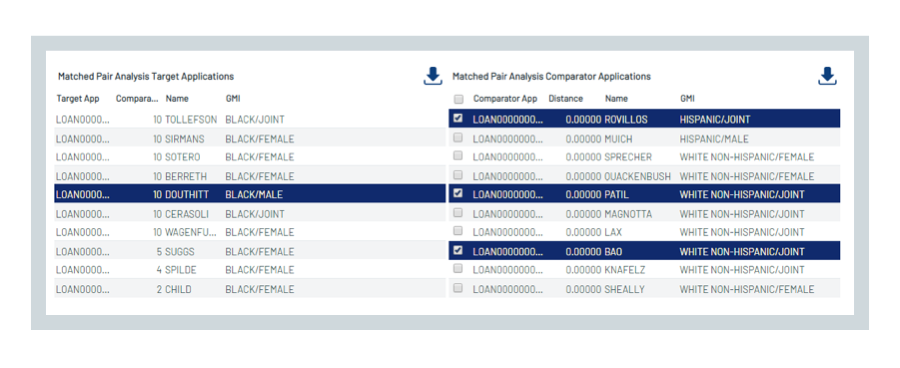

Enables the automatic identification of outliers to find loans that were priced higher or denied compared to lending actions involving similar applicant cases.

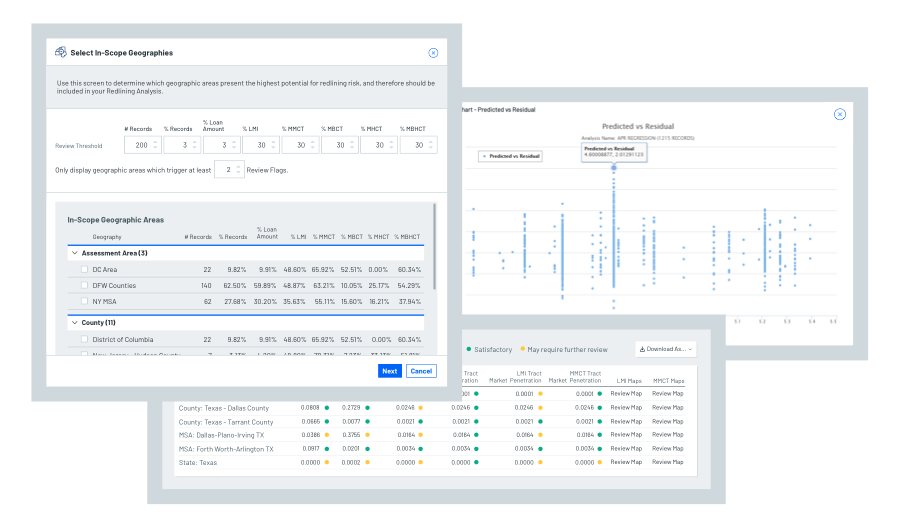

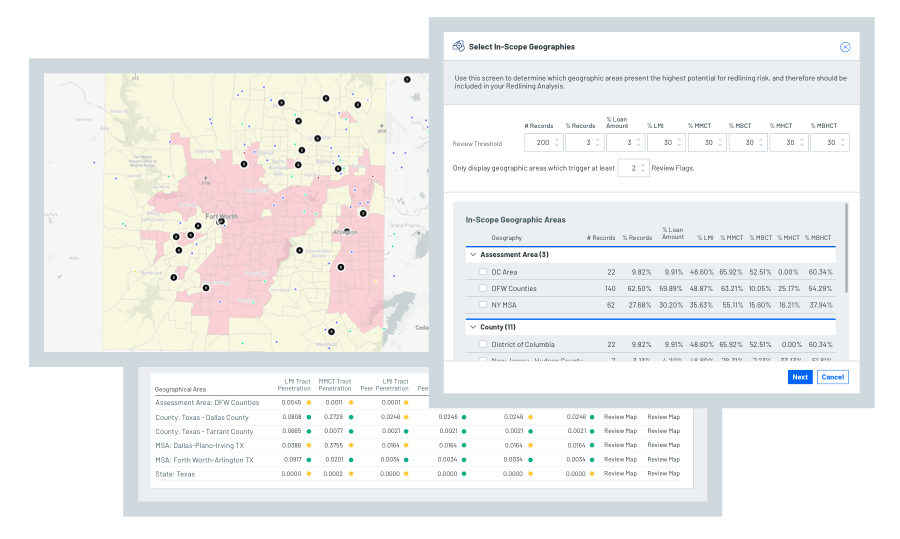

Informs decision-making using geographic markets of concern, aggregate peer data, and peer group comparisons.