Learn more about the Goals Module and its key monitoring and reporting features.

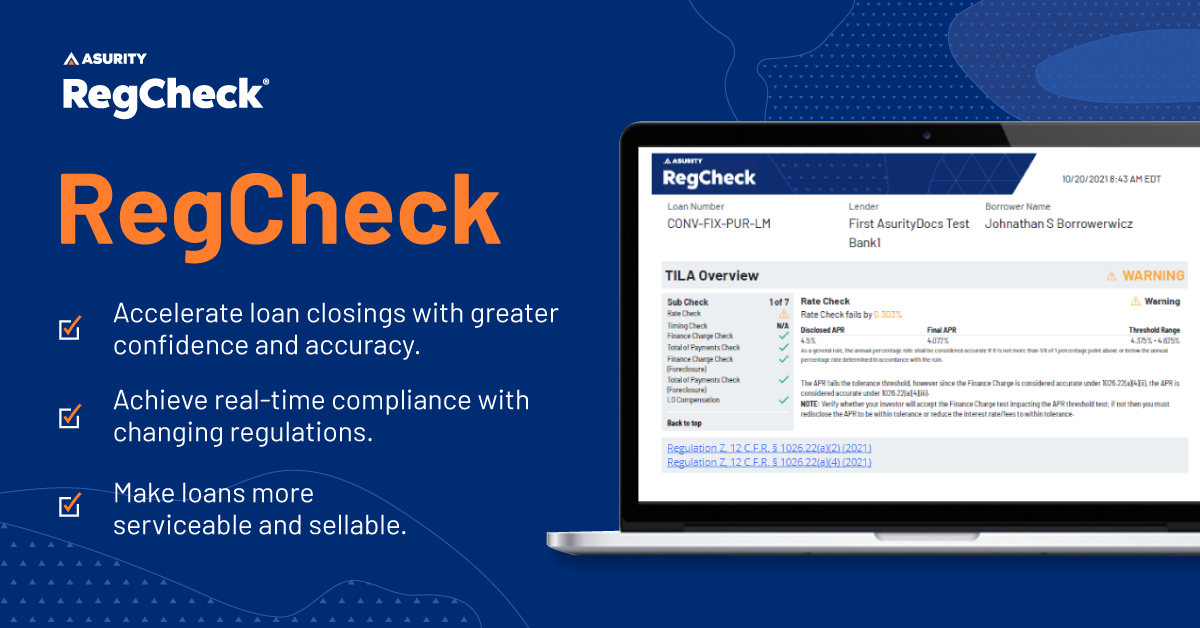

Asurity, the leader in mortgage regulatory compliance technology, has launched its newest software solution to revolutionize the industry: RegCheck®. This comprehensive suite of compliance checks was built with input from internal experts and law firm partners to deliver complete compliance confidence to key decision-makers in the mortgage industry. With RegCheck, users can perform compliance testing, understand calculation methodology, and verify compliance regulations, all in one cohesive technology suite.

RegCheck is everything financial institutions need to check for compliance violations, identify risks, address issues, and confirm compliance all in one tool. This compliance software powerhouse links test results to their root cause, empowering financial institutions to remediate even the most challenging compliance issues. It also analyzes test failure at any stage of loan origination, allowing organizations to quickly comprehend crucial data throughout the lifetime of the loan.

With RegCheck, you can easily automate the identification of common root cause failures and let your team get back to the other essential elements of their jobs. RegCheck was built to prioritize the customer experience, allowing you to clearly understand your mortgage regulatory compliance results in a concise snapshot of each test using straightforward terminology. By leveraging the advantages of innovative technology, RegCheck is built for faster loan processing and real-time compliance with ever-changing regulations, allowing lenders to contend with strong volumes and drive cost efficiencies.

RegCheck runs comprehensive compliance checks, including:

In today’s mortgage environment, home buyers expect speed, convenience, seamlessness, and transparency from lending organizations. An efficient and comprehensive mortgage lending solution has become crucial for ensuring compliance and customer satisfaction throughout the entire lending process. Other regulatory performance technologies exist for financial institutions, but RegCheck from Asurity offers features exclusive to this mortgage compliance software.

The interactive PDF compliance report enhances user experience by providing a quick snapshot of test results and actionable insights into the calculation methodology that accelerates comprehension of contributing factors to failed test results. Users can seamlessly navigate between different test results and focus on specific areas of deficiency or success.

Your compliance checks are only as helpful as the actions they empower you to take. Not only does RegCheck automate compliance analysis for your organization, but it also provides actionable insights to users by demystifying the loan data used to run these tests, enabling users to use powerful data to address risks directly.

RegCheck is designed to seamlessly integrate with your existing technology via an API, including your loan origination system (LOS). This integration allows users to input fees and other loan information pertinent to data collection without skipping a beat.

The goal of RegCheck is to deliver complete compliance confidence to key decision-makers in the mortgage industry. That’s why our internal experts partnered with compliance law firms throughout the development of this all-in-one solution — to ensure every essential compliance check is covered from the perspectives of both the institution and governing agency.

Comprehensive data and analytics are not very helpful if they can’t be understood and acted upon by your financial institution. RegCheck provides a clear snapshot of any compliance issues and successes in your organization using a straightforward dashboard. Stop spending hours deciphering results, and dive straight into informed decision-making to improve your compliance rating.

RegCheck is built to flex with any tech and management workflow. Whatever current systems, technology, and workflows your organization has in place, RegCheck will fit seamlessly into your operations. When looking to get started with an all-in-one compliance mortgage compliance software, RegCheck’s integration flexibility creates a hassle-free setup process that doesn’t interfere with, and in fact, enhances, all of your current workflows. This means that very little is required of your financial institution when it comes time to deploy the RegCheck solution for your company. To learn more about RegCheck or to schedule a demo, connect with Asurity’s regulatory and compliance experts.

Learn more about the Goals Module and its key monitoring and reporting features.

Learn about the changes of state consumer protection and the responsibility of financial services institutions to pursue operational excellence and a culture of compliance.

Regulatory and technology experts discuss innovation, CRA reforms, and how single-close construction loans are reenergizing rural America.